philippines car tax|Revamp of vehicle tax needed — IMF : Baguio The extended warranty is another dealership fee that you might need to pay. It is extra coverage for the car's major repairs . Tingnan ang higit pa Explore Reece’s range of high-quality toilet spare parts & accessories, find everything you need to fix & maintain your toilet. Shop online or in-store now. Toilet Parts & Accessories . Top Fix Cistern Bolts (Pair) Product Code: 9503903 -+ Please enter a valid quantity. My Price $0.00 (inc.gst) CMP $0.00 (inc.gst) Enter your postcode to see .50,113 talking about this. Welcome to my official facebook page ang page na to ay para lang sa mga 3d lottory & guide thank you!. Watch.

PH0 · Understanding taxes and fees when buying a car in the

PH1 · Revamp of vehicle tax needed — IMF

PH2 · Revamp of vehicle tax needed — IMF

PH3 · Pickup prices PH 2023: Hilux, Navara, Ranger, Strada, D

PH4 · Pickup prices PH 2023: Hilux, Navara, Ranger,

PH5 · Overview of Certificate Authorizing Registration in the Philippines

PH6 · New Excise Taxes on Cars: BIR Revenue Regulation RR 5

PH7 · LTO Fees in the Philippines for 2024

PH8 · Import taxes for EVs suspended for five years with

PH9 · House OKs bill to hike car taxes on 2nd reading

PH10 · Excise Tax

PH11 · 4 Questions About Excise Tax on Cars in the Philippines

PH12 · 4 Questions About Excise Tax on Cars in the Philippines

autumn nelson onlyfans colorsofautumn nude videos leaked . jerii.nelson Nelson mauri Luiza Nelson only fans Katherine nelson Mia Nelson Laurie nelson BBC full nelson pink doll nelson Helen nelson Stephani Nelson @stephanie Nelson curve plus size modelo xxx Nelson Mandingo X @stephanie Nelson xxx Nikki .

philippines car tax*******Most often, car buyers are surprised by the sales tax on a new car. Say, a 9% sales tax on a 1.5-million-peso car is 135,000 pesos. Different cities and countries usually add their own tax topping the state tax. So, most probably, the amount you will pay varies within a country or state. Sales Tax Rate . Tingnan ang higit paIt is the cost of vehicle delivery from the factory to the dealership. It is often shown on the sticker on the vehicle’s window. This . Tingnan ang higit paThe processing fee is also called a documentation fee. Every dealership puts a charge for the processing. This fee cover’s . Tingnan ang higit paThe extended warranty is another dealership fee that you might need to pay. It is extra coverage for the car's major repairs . Tingnan ang higit pa

Almost all manufacturers charge the dealership for the brand’s national advertising. The charge is included in the dealer-invoice price. The regional dealer association can also impose assessments covering . Tingnan ang higit pa

Car excise tax in the Philippines: Overview. 1. Why was the excise tax on cars updated? 2. What is the effect of the car tax .

Excise Tax is a tax on the production, sale or consumption of a commodity in a country. APPLICABILITY: On goods manufactured or produced in the Philippines for domestic . Pinoy Money Talk. The Bureau of Internal Revenue (BIR) has released the implementing guidelines related to the revised Excise Taxes to be charged on cars and .By: Garry S. Pagaspas. Certificate Authorizing Registration (CAR) in the Philippines is one issued by the Bureau of Internal Revenue (BIR) in relation to transfers of certain .

A component of the Philippine government's tax reform program under Republic Act 8794, [1] the MVUC collected from vehicle owners in the Philippines is used for financing the maintenance of .

Here are the estimated prices of every mainstream PH pickup after excise taxes are applied. We crunched the numbers. by Kat Chua | Sep 19, 2022. PHOTO: TopGear.com.ph. In 2017, the government .

ADVERTISEMENT. The bill will change motor vehicle users’ charges into motor vehicle road users’ taxes (MVRUT) if enacted. The tax will gradually increase, .Revamp of vehicle tax needed — IMF The Most Favored Nation (MFN) tariff rates will be cut to zero percent on built imported EVs covering vehicle segments such as passenger vehicles, buses, minibusses, trucks, bicycles, motorcycles, .

THE PHILIPPINES should con sider revamping the taxation of passenger vehicles to take into consideration their impact on the environment, the International Monetary Fund (IMF) said. In a report, the . 📌 Special Taxes. In addition to national taxes and local taxes, there are special taxes [8] that must be paid during certain transactions or purchases:. Motor Vehicle User’s Charge (MVUC) – An annual fee .Concepts of Excise Tax Excise Tax Rates Related Revenue Issuances Codal References. BASIC CONCEPT: Excise Tax is a tax on the production, sale or consumption of a commodity in a country. APPLICABILITY: On goods manufactured or produced in the Philippines for domestic sale or consumption or for any other disposition; and. On goods .

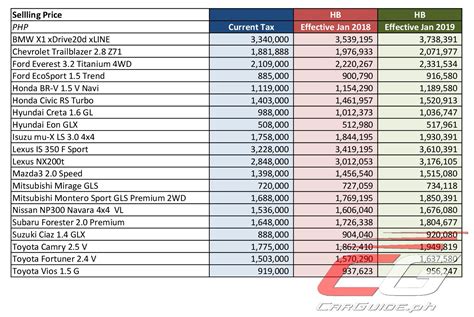

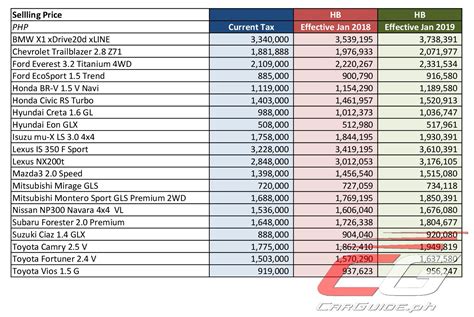

philippines car tax Revamp of vehicle tax needed — IMF In 2017, the government imposed new excise tax rules on all automotive vehicles. The ruling—which spurred a buying spree prior to its implementation—essentially reduced the taxes paid for lower-priced .Tax Guide on Philippine Taxation; TAX GUIDE ON PHILIPPINE TAXATION. LAWS . THE CONSTITUTION OF THE PHILIPPINES (constitutional limitations) 1987 Constitution . . Special Purpose Vehicle Act . available at the BIR library (Republic Act 9182) ADMINISTRATIVE MATERIALS . Revenue Regulations - BIR site . 1960s-2002 .Certificate authorizing registration (CAR) in the Philippines is in effect a tax clearance issued by the Bureau of Internal Revenue (BIR) relative to the transfer of certain properties. Once issued, it would mean that applicable taxes on such transfers of properties are being paid – capital gains tax in the Philippines, documentary stamp tax .Tax your vehicle. Tax your car, motorcycle or other vehicle using a reference number from: a recent vehicle tax reminder or ‘last chance’ warning letter from DVLA. your vehicle log book (V5C . New vehicle sales in the Philippines stood at 32,173 units during March, . In 2018, the Philippine government increased excise tax for vehicles priced below PHP600,000 (USD11,584) to 4%, up from 2% in 2017. Excise tax on vehicles priced between PHP600,000 and PHP1.1 million has been set at 10%; vehicles priced at more .

Revenue Regulation 25-2003, as amended by Revenue Regulation 05-2018, provides for the schedule of automobile AVT rates. 3. Value Added Tax (VAT). For automobiles, the rate is 12% based on the sum of the Landed Cost (LC) and the Ad Valorem Tax (AVT). For other vehicles, the rate is 12% based on the Landed Cost (LC). 4. Import .Jul 26, 2020 03:00 PM. The planned grant of tax incentives to electric vehicle sector has been seen as a debatable policy proposition, according to Senate Committee on Energy Chairman Sherwin T. Gatchalian. Gatchalian, author of Senate Bill No. 1382, otherwise known as the Electric Vehicles and Charging Station Act, indicated the plan as .philippines car taxBelow are the 20 items subject to creditable withholding tax in the Philippines under TRAIN or RA 10963): 1. Withholding tax on professional fees, talent fees, etc. for services rendered – 5% /10% individuals or 10%/ 15% corporations (Sec. 2.57.2 (A), RR 2-98) By implications of the tax reforms under TRAIN RA 10963 in Philippines, withholding . Under Section 34 (F) of the Tax Code of the Philippines, there shall be allowed as a depreciation deduction a reasonable allowance for the exhaustion, wear and tear (including reasonable allowance for obsolescence) of property used in trade or business. To implement this provision, the Bureau of Internal Revenue (BIR) issued .A. Tax Rate in General – on taxable income from all sources within the Philippines: same manner as individual citizen and resident alien individual: B. Certain Passive Income: Tax Rates: 1. Interest from currency deposits, trust funds and deposit substitutes: 20%: 2. Royalties (on books as well as literary & musical compositions) 10% - In .

Tag Archive for "FBT Philippines" - Tax and Accounting Center, Inc. Cars or motor vehicles is a common fringe benefit of employers to managerial and supervisory employees in the Philippines. Usual executive compensation package would provide a car plan under varying terms. For employers, motor vehicles are indispensable to its operations and it . By: Tax and Accounting Center Philippines. Bureau of Internal Revenue issued Revenue Memorandum Circular No. 40-2014 dated 12 May 2014 entitled “Prescribing the Use of Electronic Certificate Authorizing Registration (BIR Form No. 2313-R For Transactions Involving Transfer of Real Properties and BIR Form No. 2313-P for .The tax rate is 5% for the first P100,000 and 10% in excess of P100,000 of the net capital gains. This means that the cost of the shares and the related selling expenses are deductible. In case of under declaration of the actual selling price, the taxpayer would be subjected to donor’s tax in the Philippines at the rate of 30% of the amount . Example: Nissan Leaf, a plug-in electric vehicle (EV), still costs about today Php3 million pesos ($56,000, about Dh210,000) in the Philippines. The same model costs just $27,400 (for the base S .Latest New Car Reviews & News & Videos. Read from over 300 expert reviews in the Philippines, from the performance, comfort, tech features and safety aspects of each vehicle. Also, find the latest vehicle launches, upcoming vehicles, vehicle recalls and latest news. The 2024 Toyota Wigo G CVT is proof that you can still get more for less .Essentially, there are three kinds of tariff which the government adds to the price tag of an automobile sold in the Philippine market: (1) import duty, if the car is imported (most of them are), (2) excise tax and (3) value-added tax. The excise tax computation was recently revised under the Tax Reform for Acceleration and Inclusion Act, and .

Baccarat New York Madison. Baccarat Boutiques. 635 Madison Avenue New York New York 10022 US +1 212-826-4100. View details . 827 m Scully & Scully. Inc. Authorized retailers. 504 Park Avenue NEW YORK New York 10022 US +1 212-755-2590. View details . Stores Baccarat

philippines car tax|Revamp of vehicle tax needed — IMF